In today’s fast-paced trading environment, precision and speed are critical. The Gainzalgo V2 Alpha TradingView tool is designed to help traders cut through market noise and focus on reliable insights. Instead of relying on guesswork or lagging data, this advanced indicator integrates with TradingView to deliver actionable trade signals for better decision-making.

Why Smart Indicators Matter in Modern Trading

Markets move faster than ever. News, economic reports, and institutional activity can shift trends within minutes. Traders who depend solely on gut instinct or outdated charts often struggle to keep up. That’s where smarter tools step in.

With platforms like Gainzalgo V2, traders gain access to a structured way of reading price movements. Unlike traditional indicators that may repaint or lag behind market action, algorithm-driven tools aim to provide clarity in real time. For active traders, this can mean the difference between spotting an opportunity early or watching it pass by.

The Role of TradingView in Smarter Decisions

TradingView has become the go-to platform for millions of traders worldwide thanks to its clean charts, social features, and ability to integrate custom scripts. Having an advanced algorithmic trading indicator built directly into this platform means you don’t have to juggle multiple tools or dashboards.

Instead, the Gainzalgo V2 Alpha TradingView setup allows you to receive trade signals directly where you analyze your charts. This seamless integration reduces friction and saves time both essential factors in fast-moving markets.

What Makes Gainzalgo V2 Alpha Different?

Not all indicators are created equal. Many traders have experienced the frustration of using a tool that looks good on paper but falls short in real trading. Gainzalgo addresses this gap by focusing on three key areas:

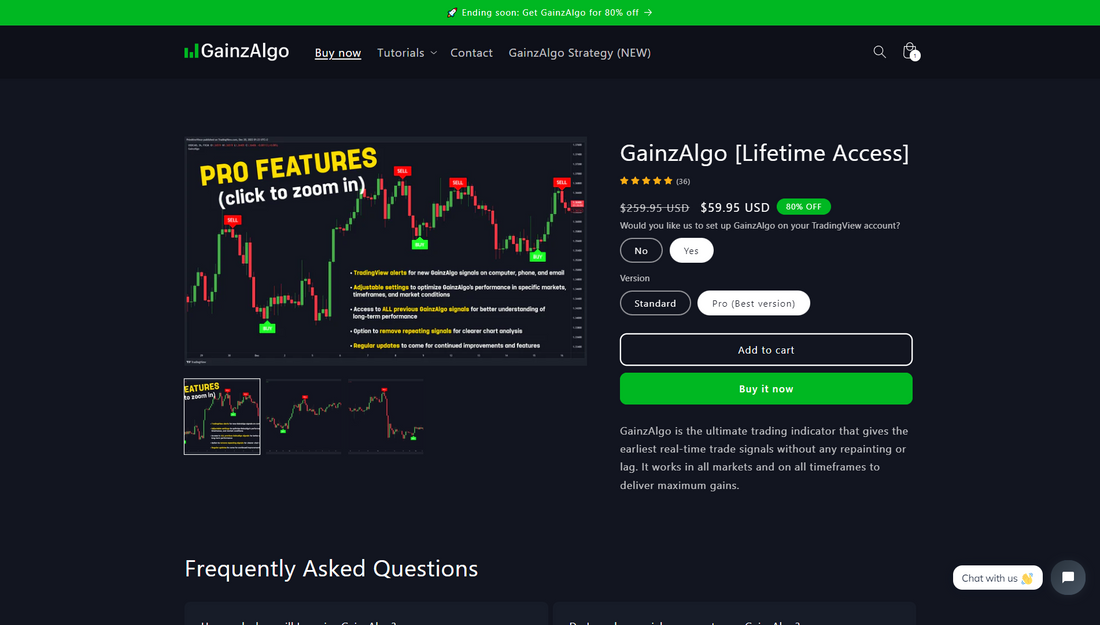

Accuracy of signals – Designed to filter out false positives, helping traders avoid unnecessary entries.

Ease of use – Clear chart visuals and straightforward alerts make it user-friendly, even for beginners.

Adaptability – Whether you’re trading stocks, forex, or crypto, the system adjusts to different market conditions.

By combining these strengths, the tool positions itself as more than just another script it becomes a reliable companion for both new and seasoned traders.

Real-World Example: How It Works

Imagine you’re tracking Bitcoin on TradingView. Price is consolidating, and you’re unsure whether it will break up or down. Instead of second-guessing, you activate the Gainzalgo system. Within moments, you get a trade signal supported by confirmation indicators, showing a higher probability for an upward breakout.

This doesn’t guarantee profits no tool can but it gives you a structured way to approach the trade, lowering emotional stress and improving consistency.

Smarter Trading Through Algorithms

The core of Gainzalgo’s approach lies in its algorithmic foundation. While many traders still rely on subjective chart patterns, an algorithmic trading indicator operates on logic and predefined rules. This removes much of the bias that often leads to mistakes.

Algorithms excel at spotting subtle market changes that the human eye might miss. For instance, they can detect shifts in momentum before a trend becomes obvious, offering traders a chance to position themselves ahead of the crowd.

How Gainzalgo V2 Alpha Benefits Different Traders

Every trader has a unique style, but reliable signals remain universally valuable. Here’s how this tool fits into different strategies:

Day traders – Quick signals help them act on short-term volatility.

Swing traders – Confirmation alerts support holding trades with more confidence.

Investors – Even long-term investors can use signals to refine entry and exit points.

The ability to adapt across multiple asset classes makes it flexible for traders who diversify across stocks, forex, and crypto.

Building Confidence With Data-Driven Trading

Confidence in trading often comes from preparation and reliable tools. Without them, hesitation and second-guessing can sabotage even the best setups. By leveraging this, traders equip themselves with clear insights backed by algorithmic logic rather than emotional reactions.

Recent surveys show that traders who use data-driven strategies are more likely to remain consistent compared to those who rely solely on intuition. While the market will always carry risk, tools like Gainzalgo reduce the uncertainty that often drives poor decisions. Discover more strategies on Twitter

The Future of Smarter Trading

The rise of advanced trading systems signals a larger trend in finance: automation and data are becoming central to success. As markets continue to evolve, traders who embrace smarter indicators will stay ahead of the curve.

The Gainzalgo V2 Alpha Indicator represents this shift. It’s not about replacing human judgment but enhancing it. By blending human intuition with algorithmic precision, traders gain a sharper edge in competitive markets.

And as more platforms integrate such technology, the line between professional and retail trading tools continues to blur giving everyday traders access to resources that were once reserved for institutions.

In trading, every decision counts. While no tool eliminates risk, choosing smarter systems can tip the odds in your favor. The Gainzalgo V2 Alpha TradingView approach offers a blend of clarity, speed, and adaptability three elements that can transform how traders approach the markets.